The Vital Role of Bookkeeping for Attorneys’ Financial Health

Table of Contents In the complex world of law, attorneys face a unique set of financial challenges. From managing trust

When costs are increasing everywhere from gas prices to products and services, it can cause major concern for your business. Inflation and the increase of the federal interest rate has prompted corporations and business owners to re-evaluate their financial statements and cash flow.

Due to this change in value, the current financial data in your reports will have little relevance for your sales forecast, cost analysis, and other strategic plans. Therefore, it is important to adopt inflation accounting to get a more realistic picture for the future of your business.

Related Post: How to Manage Your Cash Reserves During Inflation

Inflation accounting is a type of accounting where financial statements are adjusted based on index prices rather than traditional costs. It allows your incomes and expenses to be compared to other companies in inflation settings. Inflation accounting uses historical data, and it provides more information than basic accounting does.

Inflation is the decline of purchasing power of the dollar over time due to price increases. When there is a sharp increase during times of crisis, hyperinflation occurs, and therefore, you will want to account for it correctly and proactively.

Here are two main methods of accounting for inflation:

This method is where you adjust the financial statements to the current price. With this method, monetary and non-monetary items are separated. The monetary items are recorded as a net gain or loss. However, for non-monetary items, you take the historical figures and apply an inflation conversation rate based on the consumer price index (CPI).

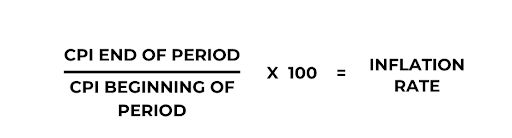

To find the inflation conversion rate, divide the CPI at the end of the period by the CPI at the beginning of the period and multiply it by 100.

Related Post: Why Hire an Accountant?

This method values the assets at their fair market value (FMV) rather than at their historical cost. All monetary and non-monetary assets are adjusted to their current values. Also, the depreciation of fixed assets are calculated at replacement value.

Both accounting methods can help you understand the financial value of your business in a positive way. Through inflation accounting, you can properly adjust your financial data and accounting numbers and compare them to current costs to give you a more accurate profitability breakdown.

At Assemblage LLC, we offer bookkeeping and accounting services to small and medium-sized businesses. We can assist you with financial analysis and help you understand your revenue streams so you can beat the inflation rates and plan for the future! Contact us today.

Table of Contents In the complex world of law, attorneys face a unique set of financial challenges. From managing trust

Table of Contents Small businesses often encounter a unique set of challenges as they seek to expand. From limited resources